Elon Musk’s artificial intelligence company, xAI, is reportedly raising $20 billion in one of the largest private AI financing rounds to date, with Nvidia contributing $2 billion in equity. The funding round combines $7.5 billion in equity and $12.5 billion in debt, structured through a special-purpose vehicle (SPV) designed to accelerate xAI’s data center expansion.

Financing Structure and Strategic Purpose

According to Bloomberg, the SPV will acquire Nvidia GPUs that will power xAI’s upcoming Memphis data center, Colossus 2. The AI firm plans to rent out these chips to third parties, providing investors a faster path to returns while scaling access to critical compute resources.

The debt financing will be secured by Nvidia’s graphics processing units (GPUs), a structure that is becoming increasingly common among venture-backed AI companies building large-scale infrastructure. The approach provides both asset-backed security for lenders and expanded access to GPU capacity for developers and enterprises.

Nvidia’s Expanding AI Investment Portfolio

Nvidia’s investment in xAI adds to its growing list of AI holdings. The semiconductor leader already backs OpenAI, one of xAI’s primary competitors, along with Perplexity, Cohere, and several AI infrastructure companies including Crusoe and Lambda.

These investments are part of Nvidia’s broader strategy to strengthen its position as both a critical supplier and financial partner within the AI ecosystem. By embedding itself across multiple tiers of the value chain, Nvidia is ensuring sustained demand for its chips while deepening relationships with the industry’s most influential AI developers.

Beyond Investments: Partnerships and Acquisitions

Nvidia’s involvement in the AI sector extends beyond venture capital. The company recently signed a $100 billion partnership with OpenAI to supply GPUs for training and inference workloads across next-generation data centers.

In another major move, Nvidia completed a $900 million acquisition of Enfabrica, a semiconductor technology startup, marking one of its first acqui-hire deals. The acquisition brought in key engineering talent and advanced chip licensing that will further enhance Nvidia’s compute efficiency and scalability.

xAI’s Position in the Competitive AI Landscape

Founded in 2023, xAI aims to create general-purpose AI systems with applications across Tesla, X (formerly Twitter), and other Musk-led ventures. The $20 billion round demonstrates the intense investor appetite for AI infrastructure and the growing importance of hardware-backed financing as model training costs continue to rise.

By partnering with Nvidia, xAI gains not only significant capital but access to advanced GPU resources that will accelerate its data center buildout and strengthen its position against established players like OpenAI and Anthropic.

The Broader Impact on AI and Capital Markets

Nvidia’s latest investment underscores a new chapter in AI financing. Traditional equity and debt models are merging with hardware-backed structures, giving investors more transparency and collateral security. For the AI industry, this represents the intersection of technology, capital, and infrastructure — where compute capacity itself becomes a tradable asset class.

As competition intensifies, these hybrid financing models will likely shape how the next generation of AI companies secure capital and scale globally.

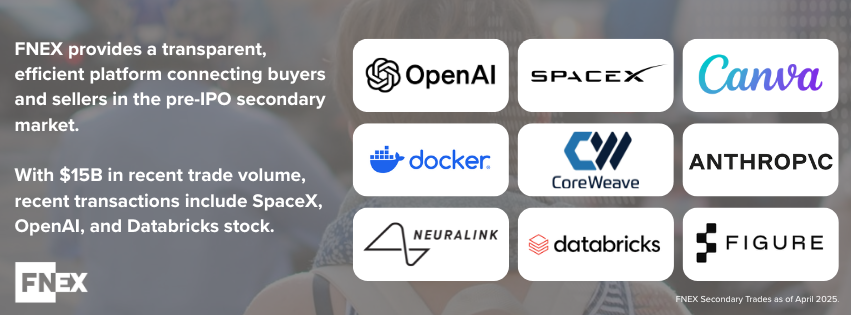

Unlock Access to Private Securities with FNEX

FNEX offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FNEX provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FNEX PRE-IPO MARKET

Contact FNEX today to gain an edge in the evolving pre-IPO secondary market.

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC. The FNEX Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.