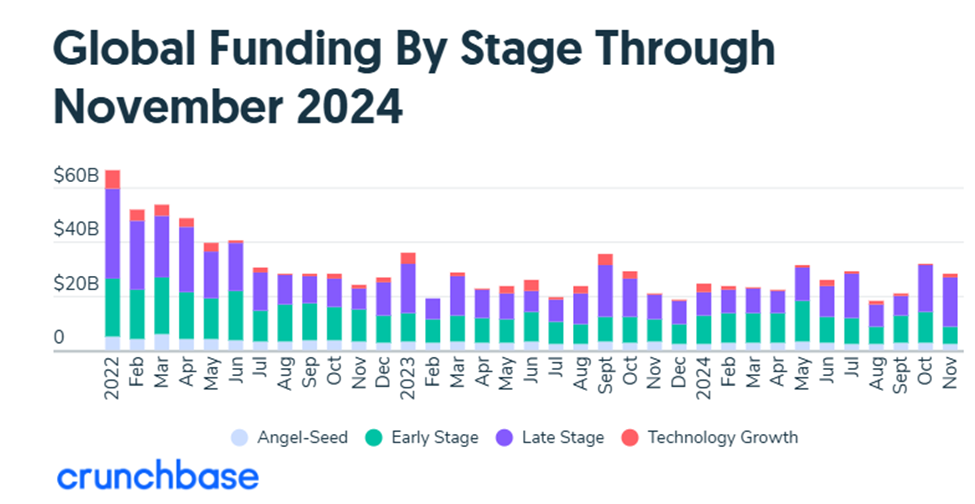

According to Crunchbase, global venture capital (VC) funding reached $28 billion in November 2024, marking an impressive increase from the $21 billion recorded in November 2023, though slightly trailing the $32 billion raised in October this year. This significant momentum underscores the growing confidence in late-stage investments and AI-driven innovation as core drivers of the market.

Billion-Dollar Deals Dominate

A substantial share—over one-third—of November’s funding came from three massive billion-dollar-plus rounds. Leading the charge were AI foundational model companies xAI and Anthropic, alongside Tricentis, a leader in quality engineering and testing services. These mega-deals not only highlight the consolidation of capital in high-growth potential sectors but also underscore the role of AI in reshaping investment landscapes.

Billion-dollar funding rounds have steadily gained prominence, comprising 16% of global venture capital this year, a modest rise from 15% in 2023 and a significant leap from the 5% seen in 2022. This trend suggests that investors are focusing on fewer but larger bets, driven by the outsized potential of specific industries like artificial intelligence.

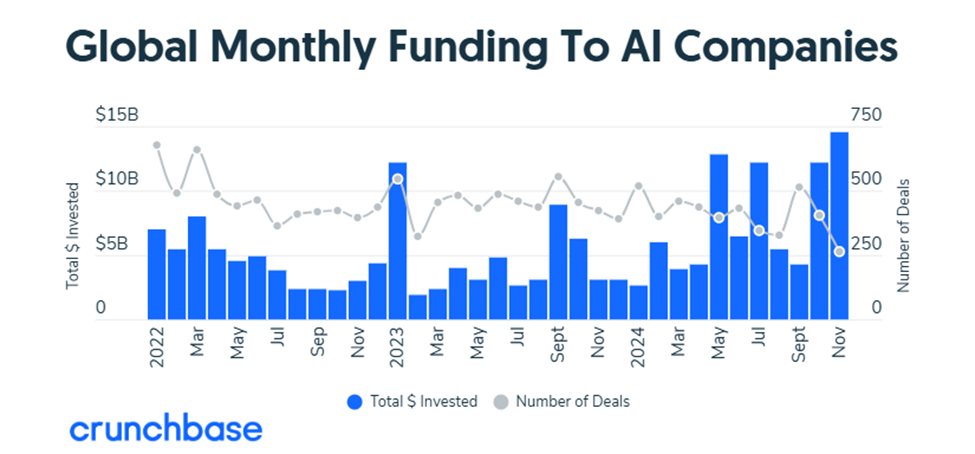

AI Takes Center Stage

Artificial intelligence remains a hotbed of investment activity, capturing over $14 billion—more than half of the total VC funding in November. AI funding cuts across various industries, from healthcare, security, and robotics to marketing and autonomous systems. This broad adoption highlights the transformative nature of AI across multiple sectors, cementing its role as a core pillar of technological advancement and economic growth.

Shifts in Funding Dynamics

While late-stage funding doubled year-over-year in November, reflecting a robust appetite for scaling mature startups, early-stage and seed funding have shown signs of contraction. Seed funding dipped by roughly a third compared to the same period last year, totaling just over $2 billion. Early-stage funding also fell by more than 20% year-over-year.

These declines raise concerns about the sustainability of the pipeline for future VC deals. Historically, seed funding has been the lifeblood of innovation, particularly resilient even during economic downturns. However, the current contraction signals a cautious sentiment among smaller and mid-sized funds, many of which have struggled to close in 2024.

Market Impact and Trends

- Increased Capital Consolidation: The growing proportion of billion-dollar-plus deals points to the increasing consolidation of capital among a few high-potential players, particularly in AI. This could potentially stifle diversity in innovation, as smaller startups may struggle to secure adequate funding.

- AI as a Catalyst: The AI sector’s dominance in funding underscores its centrality to economic and technological transformation. As AI startups drive both vertical and horizontal market integrations, industries reliant on traditional processes may face intensified competitive pressures.

- Early-Stage Caution: The decline in seed and early-stage funding raises questions about the future of the startup ecosystem. Without a healthy influx of early-stage investments, the pipeline for late-stage funding may narrow in the coming years, potentially limiting long-term growth opportunities in venture capital.

- Investor Strategy Realignment: Late-stage and mega-deal focus suggests that investors are prioritizing safer bets and scaling potential over exploratory or unproven ventures, aligning with broader economic caution.

Looking Ahead

As we head into 2025, the key question remains whether early-stage funding will continue to contract or rebound as macroeconomic conditions stabilize. With AI and late-stage investments proving lucrative, there is a clear focus on scalability and transformative technology. However, nurturing the broader startup ecosystem is essential for sustainable innovation and diversification of investment opportunities.

Reference

This analysis is based on Crunchbase data, highlighting trends and insights into global VC funding dynamics. For a detailed breakdown, visit the Crunchbase News article.

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC.