AI Startup Expands Ambition with Major Backing

Poolside, the AI startup developing advanced models to assist software developers, is reportedly finalizing a significant funding round led by semiconductor leader Nvidia.

According to Bloomberg, Nvidia plans to invest between $500 million and $1 billion as part of Poolside’s $2 billion raise, which would value the company at $12 billion.

This would be Nvidia’s second investment in Poolside after its participation in the company’s $500 million Series B round in October 2024. The move demonstrates Nvidia’s strategy to strengthen its foothold across the AI software ecosystem that powers demand for its GPUs.

Bridging Hardware and AI Software

Poolside’s mission is to automate software development using large-scale language and reasoning models designed to write, refactor, and optimize code.

By aligning with Nvidia, Poolside gains access to both strategic capital and advanced computing infrastructure—positioning it to accelerate its product development and market adoption.

For Nvidia, the investment supports its long-term vision of expanding beyond chips into the software layer that drives AI workloads. Similar investments, such as Nvidia’s $500 million into Wayve and $5 billion stake in Intel for chip collaboration, illustrate the company’s commitment to integrating across the entire AI value chain.

Implications for Institutional Markets

This convergence of hardware and AI software represents more than a technology play—it has strategic and regulatory implications for financial institutions and wealth managers. AI systems that automate development and decision workflows will soon influence vendor oversight, compliance frameworks, and data governance requirements.

As financial firms adopt AI-enabled infrastructure, they must assess how vendor dependencies, model transparency, and algorithmic bias affect regulatory obligations and operational risk.

Nvidia’s potential $1 billion investment in Poolside highlights a new phase of integration across the AI ecosystem.

Hardware leaders are no longer content to supply chips, they are becoming strategic partners in the software systems that define the next generation of computing.

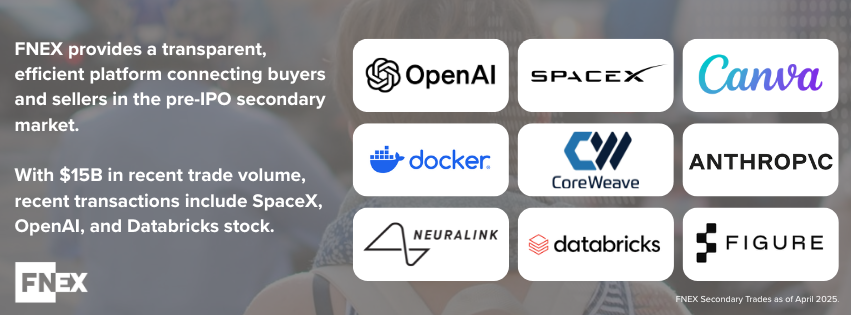

Unlock Access to Private Securities with FNEX

FNEX offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FNEX provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FNEX PRE-IPO MARKET

Contact FNEX today to gain an edge in the evolving pre-IPO secondary market.

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC. The FNEX Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.