Deel Strengthens Its Global Payroll Dominance

Global payroll and compliance leader Deel has raised $300 million in Series E funding, pushing its valuation to $17.3 billion. The round was led by Ribbit Capital, with participation from Andreessen Horowitz, Coatue Management, and General Catalyst, reinforcing investor confidence in Deel’s long-term vision and profitability.

Founded in 2019 by Alex Bouaziz, Ofer Simon, and Shuo Wang, Deel has become a cornerstone of the global workforce infrastructure, helping businesses manage contracts, payments, and compliance for remote employees in more than 150 countries.

Sustained Profitability and Scale

Deel reports being profitable for three consecutive years and recently surpassed $1 billion in annual recurring revenue (ARR), with a record-breaking $100 million month in September. The platform now serves 35,000+ clients and manages payroll for 1.5 million workers worldwide, numbers that underscore its dominance in the global HR technology space.

Vision for Borderless Work

According to CEO Alex Bouaziz, Deel’s goal is to “reimagine how payroll should work for the next century: fluid, real-time, and truly borderless.” This latest capital infusion will be used to expand Deel’s payroll infrastructure and technology stack, further streamlining international hiring and compliance processes for enterprises.

Investor Confidence Amid Legal Challenges

Despite ongoing legal disputes with rival Rippling, top-tier investors remain firmly committed. Ribbit’s founder Micky Malka described Deel as “a brand companies trust,” while Andreessen Horowitz co-founder Ben Horowitz praised the company for building “the best HR platform for global businesses.”

The Broader Implication for Private Markets

Deel’s latest funding round highlights the continued strength of late-stage venture investment in enterprise SaaS, particularly platforms that simplify global compliance and financial operations. Investors are prioritizing scalable infrastructure plays over consumer-facing fintech, signaling a renewed focus on operational resilience and international growth opportunities.

Reference

- Tech Crunch – https://techcrunch.com/2025/10/16/deel-hits-17-3b-valuation-after-raising-300m-from-big-name-vcs/

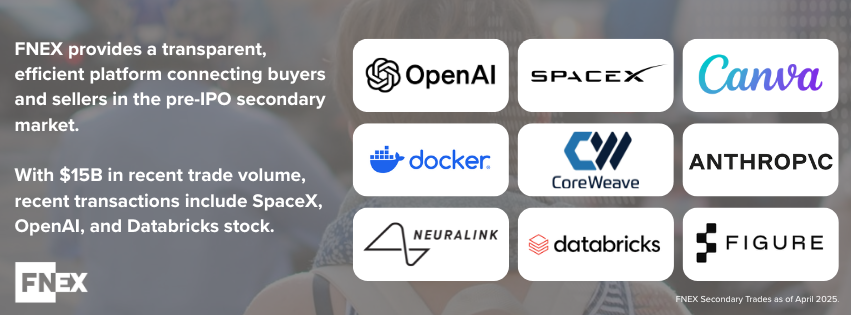

Unlock Access to Private Securities with FNEX

FNEX offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FNEX provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FNEX PRE-IPO MARKET

Contact FNEX today to gain an edge in the evolving pre-IPO secondary market.

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC. The FNEX Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.