The alternative investments market in 2024 faced headwinds across asset classes, with performance varying widely as fund managers and investors adapted to macroeconomic shifts. Insights from the Preqin Global Reports 2025, released on December 11, 2024, highlight emerging trends and offer an optimistic outlook for 2025 as policy rates ease and market sentiment improves.

Private Equity

Private equity demonstrated resilience, raising $482 billion across 646 funds by Q3 2024. Non-institutional investors, including family offices and wealth managers, showed increased interest, complementing traditional institutional inflows. With policy rates easing and economic conditions stabilizing, the private equity market is well-positioned for a strong rebound in 2025, particularly in dealmaking activity.

Venture Capital

Global venture capital assets under management (AUM) totaled $3.1 trillion by Q1 2024, with Asia-Pacific contributing $1.6 trillion, North America $1.1 trillion, and Europe $200 billion. Exit activity continued to decline in 2024, with 852 exits totaling $112 billion by Q3, compared to 1,969 exits valued at $270 billion in 2023. However, optimism grows for 2025, driven by anticipated economic recovery and improved liquidity for venture-backed firms.

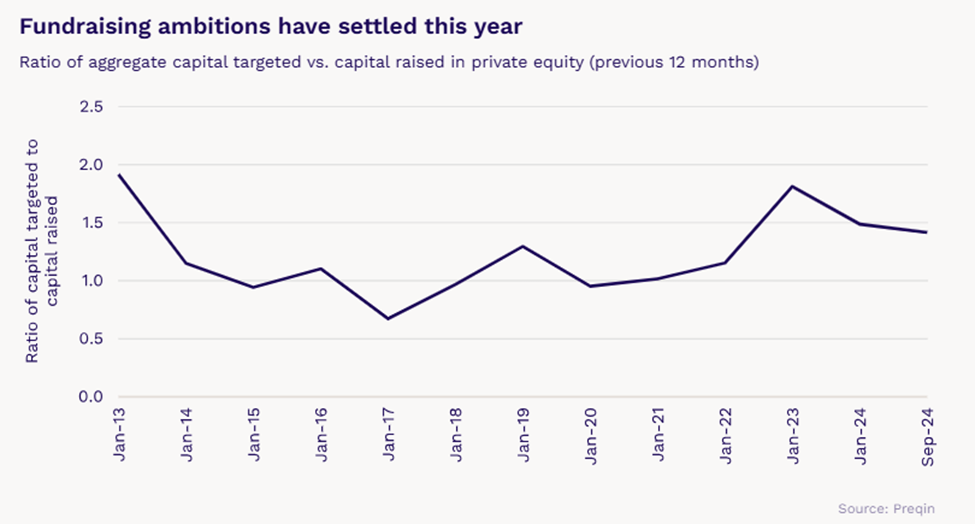

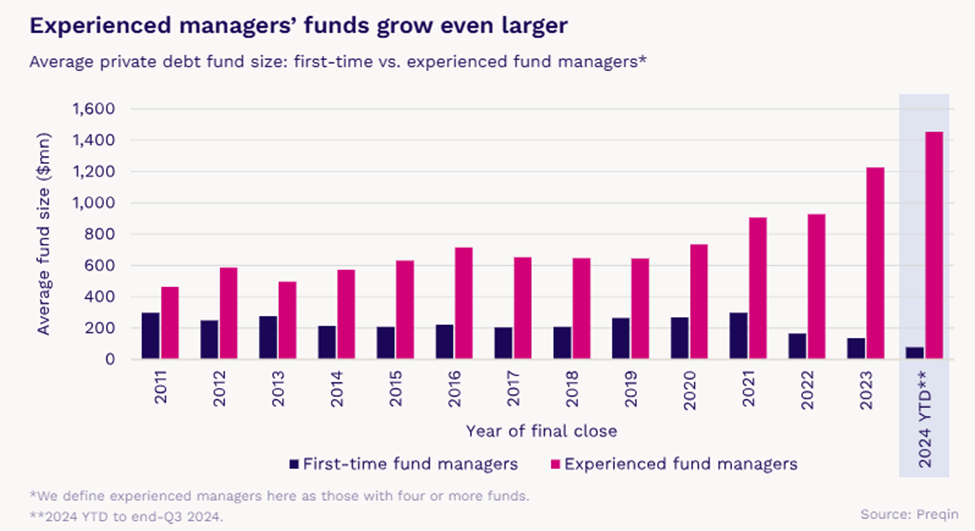

Private Debt

Private debt markets remained challenging in 2024, with fundraising recovering after a weak Q1 but unable to fully regain lost ground. Investors leaned toward defensive strategies, shifting power dynamics between fund managers and investors, particularly regarding fees. A recalibration of strategies is expected to align with evolving investor priorities.

Hedge Funds

Hedge funds delivered a 10% return through Q3 2024, achieving a 14% compound annualized growth rate (CAGR). Net inflows of $25.5 billion in Q3 brought year-to-date subscriptions to $19.2 billion. While this represents a rare positive quarter amidst a decade of net outflows, hedge funds continue to demonstrate their value as diversification tools.

Real Estate

The global real estate market showed signs of recovery, with transaction values in North America, Europe, and Asia-Pacific rebounding by Q3 2024 compared to 2023. Fundraising, however, moderated, with $96 billion raised by Q3, representing 61% of 2023’s total. Continued recovery is expected in 2025, supported by improving market dynamics.

Infrastructure

Infrastructure fundraising and deal activity remained subdued in 2024, with dry powder as a proportion of AUM falling to a historic low of 24%. Infrastructure AUM dropped 3% ($38.5 billion) in Q1. Despite these challenges, long-term demand for infrastructure remains robust, with opportunities in sustainable and resilient projects driving future growth.

Outlook for 2025

Cameron Joyce, Senior Vice President, Global Head of Research Insights at Preqin, notes: “The macroeconomic backdrop has proved more resilient than anticipated, with limited signs of financial stress. As policy rates ease, market sentiment is increasingly optimistic regarding private capital prospects. We anticipate revitalized dealmaking to bolster activity in 2025.”

The alternatives market enters 2025 with a mix of cautious optimism and strategic recalibration. Fund managers and investors are well-positioned to seize opportunities in an evolving landscape, underscoring the resilience and adaptability of private markets.

Explore the New FNEX Alternatives Market

The new FNEX Alternatives Market is an alternatives investment platform that offers curated investment opportunities for wealth managers, featuring exclusive private equity, real estate, private debt, and venture capital options. With expert support and high-quality, vetted funds, FNEX helps elevate client portfolios with confidence. Contact us today to learn more.

References

Preqin. – https://www.preqin.com/global-report

Disclaimer: The FNEX Alternatives Market is an alternatives investment platform intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.