Unlock New Private Market Opportunities with FNEX

FNEX is a global leader in private securities, offering pre-IPO stock transactions and secondary market access for institutional investors, family offices, and accredited investors. With the FNEX Institutional Dark Pool, a pre-IPO marketplace, we facilitate liquidity for large blocks of private securities, ensuring discretion and privacy throughout the process.

Contact

Why is FNEX a Global leader in Private Securities?

At FNEX, we provide a secure and efficient platform that facilitates the trading of private securities—including pre-IPO shares, by connecting qualified buyers and sellers. With over $15 billion in executed transaction volume, FNEX leads the market in providing institutional access to secondary opportunities in companies such as SpaceX, OpenAI, and Databricks. Our platform delivers transparency, execution certainty, and compliance-driven processes in a marketplace that is historically illiquid and fragmented.

Put Our Experience to Work for You

- Over $15B in recent transactions

- Global Institutional client relationships

- Vast and multi-sector private company relationships

- Proprietary secondary transaction deal flow

- Proprietary price and market data through FNEX platforms

- Unparalleled market intelligence for companies and investors

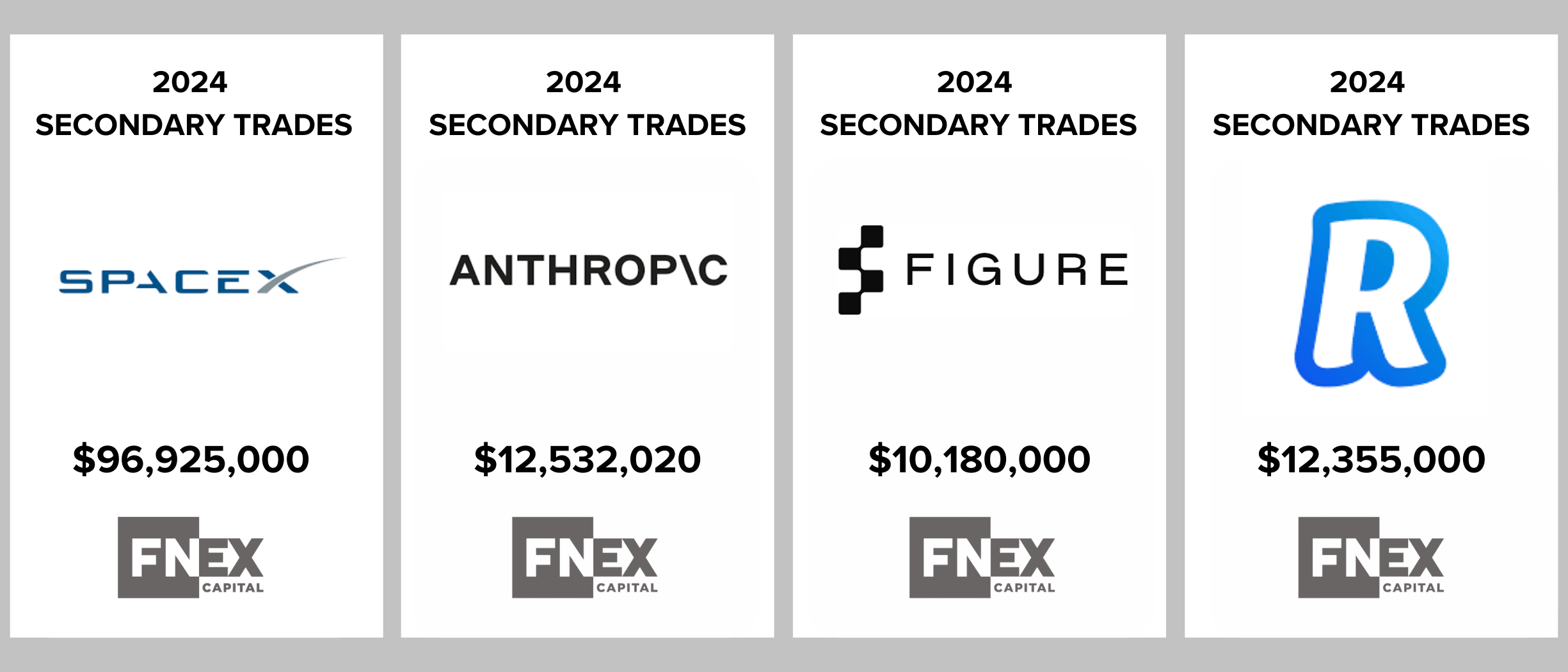

Recent Transactions

Discover the Potential of FNEX’s Pre-IPO Investment Platform

The FNEX Institutional Dark Pool offers a unique private market exchange for late-stage pre-IPO securities. Our platform includes:

- Verified bids and offers from vetted counterparties

- Secure access to non-public share transactions

- A proprietary dataset featuring historical trade metrics and valuation benchmarks

Discover private securities investing with FNEX—your gateway to alternative investment opportunities, pre-IPO liquidity, and private market innovation.

Sign up for our Institutional Dark Pool today and gain exclusive access to pre-IPO market opportunities.

CONTACT US TO SIGN UPFrequently Asked Questions (FAQ)

Who can invest on the FNEX platform?

Access to the FNEX platform is limited to:

- Institutional investors

- Accredited investors

- Family offices

- Registered investment advisors (RIAs)

This is due to the regulatory requirements governing the purchase and sale of private securities.

What is the FNEX Institutional Dark Pool?

The FNEX Institutional Dark Pool is a secure pre-IPO trading marketplace for institutional investors. It allows for the discreet trading of large blocks of private shares with full regulatory compliance, market data access, and bid/ask matching.

How do I get started?

To get started with FNEX’s private securities marketplace, simply contact us to begin the registration process as an institutional or accredited investor. Our team will guide you through the verification steps to confirm your qualifications. Once approved, you’ll gain access to our Institutional Dark Pool, where you can explore live pre-IPO opportunities, review private market data, and submit bids or offers on available private securities.

SPEAK WITH OUR TEAMDisclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC. The FNEX Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.