Institutional portfolios are being reshaped by a powerful force: the accelerated maturation of private markets. With IPO timelines extending, public market opportunities narrowing, and innovation increasingly occurring within private companies, capital allocators are shifting toward pre-IPO secondary investments to remain competitive and generate alpha.

Structural Drivers Behind the Surge in Private Securities

1. The De-Publicization of Growth

Today’s top-performing companies are choosing to stay private far longer than in past decades. Since 1999, the number of publicly listed companies in the U.S. has declined by over 40%, even as total market capitalization has grown. The result? Value creation is shifting away from public markets and toward private securities trading platforms.

Private market giants like OpenAI, SpaceX, Stripe, and Epic Games have all achieved multi-billion-dollar valuations while remaining private. These companies are defining a new growth paradigm—one where late-stage private investors realize outsized returns well before IPOs.

2. Private Market Return Asymmetry

Allocating capital to pre-IPO shares enables institutions to capture upside at a more favorable risk-return profile:

- Shorter duration to liquidity (1–3 years)

- Higher revenue visibility and operational maturity

- Backed by institutional investors with defined cap table and governance

By entering the secondary market for private shares, investors can bypass early-stage volatility while still participating in upside potential, particularly in late-stage unicorns preparing for IPO or strategic exits.

3. Innovation Is Private First

From generative AI and defense tech to fintech, innovation is increasingly driven by private firms. These companies are leveraging lean models and long-term investor capital to scale outside the public eye.

Allocators who focus solely on public equities risk missing out on the next wave of market-defining technology, much of which is being built in venture-backed, privately held companies.

FNEX: Your Institutional Partner for Access to Private Secruities

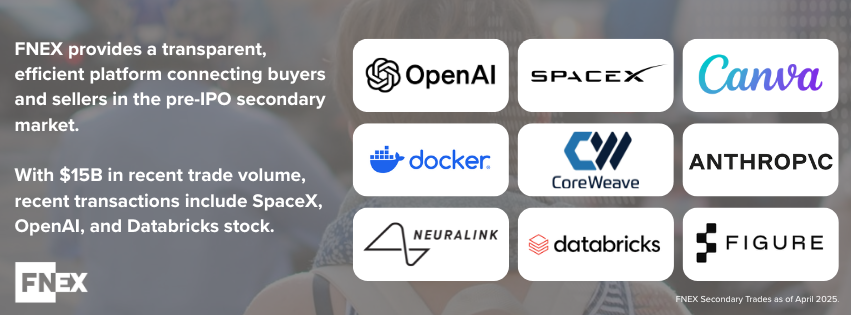

FNEX operates one of the leading private securities trading platforms for institutional and accredited investors. Our Institutional Dark Pool provides liquidity and access to large blocks of late-stage private shares in companies nearing key milestones.

LEARN MORE ABOUT FNEX PRE-IPO MARKET

Through FNEX, institutional and accredited investors can buy and sell private company stock, gain access to curated secondary market deals and rely on a seamless, compliant transaction process backed by rigorous due diligence.

In a market where traditional equity exposure is no longer enough, FNEX empowers institutions with direct access to pre-IPO investments to elevate your client offerings.

Disclaimer: The FNEX Pre-IPO Marketplace is available exclusively to institutional and accredited investors.